Asia stocks slide, gold rises as Middle East conflict sparks safety rush

- 8 months ago

Markets in Asia began the week on a cautious footing. MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.7% after Iran had, late on Saturday, launched explosive drones and missiles at Israel in retaliation for a suspected Israeli attack on its consulate in Syria on April 1.

Economic Times

Big movers on D-Street: What should investors do with HDFC Bank, Zomato and CAMS?

- 8 months ago

Here's what Santosh Meena, Head of Research at Swastika Investmart, StoxBox, recommends investors should do with these stocks when the market resumes trading today.

Economic Times

Not participating in India would be a big miss: TCS CEO K Krithivasan

- 8 months ago

TCS anticipates growth in India with a recent BSNL deal. CEO Krithivasan focuses on new markets and expresses optimism about future IT industry demand. The company's strategic deal approach and high margins drive continued success amid market challenges.

Economic Times

BSE stock is set for a fresh leg of rally; here’s why | Stock Radar

- 8 months ago

“BSE stock has given a pole and flag pattern formation breakout on the monthly frame which signifies a potential upside from these levels. Traders can buy for a target of Rs 3000 in the next 2-3 weeks,” Shivangi Sarda, Analyst, Derivatives and Technical Research, Motilal Oswal Financial Services Ltd, said.

Economic Times

Chrys Capital looks to sell GeBBS at $1b valuation

- 8 months ago

ChrysCapital, the largest homegrown PE fund, is looking to sell GeBBS Healthcare Solutions, about six years after acquiring the Los Angelesbased healthcare business process outsourcing (BPO) company, said multiple people aware of the development. A potential deal is likely to value GeBBS at $800 million to $1 billion, the people said.

Economic Times

Ex-Reliance Industries CFO joins Modulus as equity partner

- 8 months ago

He will enter with 17.3% equity stake, which is set to increase over a period of time. Modulus is raising its second fund, targeting growth in the Indian private credit market, projected to be a $100-billion opportunity.

Economic Times

Investors brace for a volatile week on D-Street

- 8 months ago

"Investors need to brace themselves for increased volatility in the coming week, given the heightened geo-political temperatures," said Aamar Deo Singh, Sr. Vice President, Research, Angel One.

Economic Times

RP sets date for second bidding for KSK Mahanadi resolution

- 8 months ago

Resolution professional sets new EoI date for KSK Mahanadi Power after failed takeover bids. Debts, creditor details, and twists in resolution process highlighted. Concerns over supporting companies' value addressed by NCLT.

Economic Times

Finmin pitches for enhanced KYC, due diligence for merchants, business correspondents

- 8 months ago

Finance ministry stresses rigorous KYC and due diligence to prevent financial frauds, focusing on data security, safeguarding the financial ecosystem, and blocking fraudulent micro ATMs. Recommendations were discussed at an inter-ministerial meeting.

Economic Times

TCS in for some bounce after a good Q4 show

- 8 months ago

"While the revenue was lower than our expectations, the margin improvement and deal wins remained robust, driven by better utilisation of resources," said Sumit Pokharna, IT analyst at Kotak Securities. "In the near term, the stock is likely to move up as the numbers are good."

Economic Times

Stocks in news: TCS, Anand Rathi, Aster DM, Bharti Hexacom, Varun Beverages

- 8 months ago

IT bellwether TCS reported better than expected numbers for the fourth quarter ended March as its profit rose 9% year-on-year to Rs 12,434 crore. Revenue from operations, meanwhile, jumped 3.5% year-on-year.

Economic Times

Volatility may cap Nifty at 22,500; trade cautiously

- 8 months ago

ICICI Bank, Reliance Industries, Mahindra & Mahindra, Eicher Motors, SAIL, IRCTC, City Union Bank and Tata Motors are among the stocks recommended by analysts for the short term.

Economic Times

Waning Mauritius FPI flows may limit tax treaty change impact

- 8 months ago

The share of funds domiciled in Mauritius in the total FPI equity assets under management (AUM) dropped to 5.61% in March 2024 compared with 14.53% five years ago, the data from NSDL showed. Consequently, Mauritius-based funds become the fourth largest investor by geography after the US(41.7%), Singapore (7.64%), and Luxembourg (7.15%).

Economic Times

When Bharat places a buy on India, D-Street can thank discount brokers

- 8 months ago

The Big Four in this business - Groww, Zerodha, Angel One, and Upstox - continue to displace traditional brokers with a 63% combined market share of active clients by the end of FY24, up 4 percentage points in a year, showed NSE data.

Economic Times

Stock Radar: Up 30% in a month! BSE hits fresh record high in April. Time to buy or book profits in this multibagger?

- 8 months ago

BSE shares rose from Rs 2,148 on March 12 to Rs 2,860 recorded on April 11, 2024, an upside of over 30% in a month. Bulls pushed the stock higher by more than 500% in a year. BSE shares rose from Rs 463 on April 11, 2023, to Rs 2,860 recorded on April 10, 2024.

Economic Times

Market Trading Guide: IRCTC, Samvardhana Motherson among 5 stock recommendations for Monday

- 8 months ago

Benchmark equity indices dropped 1% each on Friday, weighed down by financial and ITstocks, as hot US inflation data dimmed hopes of early interest rate cuts by the Federal Reserve. The S&P BSE Sensex closed 1.06% lower at 74,245, while the NSE Nifty50 index ended below the 22,550 level."A small negative candle was formed on the weekly chart with the upper shadow, indicating a reversal pattern formation as per daily as well as weekly time frame charts. This is not a good sign for bulls," said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.Here are 5 stock recommendations for Monday:

Economic Times

Pure domestic growth story: 7 companies from road construction and infrastructure sector with potential upside of up to 37%

- 8 months ago

Road construction and infrastructure as a sector first came to light close to 25 years back, when then Prime Minister Atal Bihari Vajpayee, kicked off the building of road projects with the aim to join north to south and east to west part of India. After getting off the good started, somewhere in the middle, road construction and infrastructure building got entangled in different issues, Land acquisition to banks issue and many more. Around 10 years back when the current government came to power, the first area of focus was road construction and very soon things began to change. Given the scope of improvement, it is a sector which will grow for the next two decades or even more, the only condition, policy stability. Probably road construction is a sector, where the opposition ruled state and central government has maximum coordination, the reason road infrastructure is one sector which is both economically and politically earning accretive.

Economic Times

Pushing the envelope: Financial ratios like CD ratio and many others need to be looked at in context

- 8 months ago

The narrative about the high CD ratio of private banks has been on the street for some time. But the fact is financial ratios are derivative of underlying business and the decision which management takes and not the other way round. Similarly, some ratios are used in quantitative investing and also sometimes for justifications. In the real world, every ratio has to be seen in the context of many things, right from industry to the operating matrix at that point of time. Five stocks which on a ratio may not appear to be in line with what books say but are good business to own.

Economic Times

Value of LIC's investment in Adani stocks jumps 59% to Rs 61,210 crore in FY24

- 8 months ago

LIC, the state-owned insurance behemoth, has seen a 59 per cent rise in value of its investments in Adani group companies in 2023-24 fiscal year after the conglomerate made a smart recovery since being hammered by a damning short seller report.

Economic Times

Iran-Israel war: Will Nifty bulls get trapped in crossfire and how it may impact investors?

- 8 months ago

One of the biggest impacts of the tensions in the Middle East could be on crude oil prices. Last week, oil prices neared a six-month high on concern that Iran, the third-largest OPEC producer, might retaliate for a suspected Israeli warplane attack on Iran's embassy in Damascus. After the fears came true on the weekend, analysts feared that crude oil prices, which had settled near the $90 a barrel mark on Friday, could cross the $100 level in the next few days.

Economic Times

LIC sees 59 pc jump in value of investments in Adani stocks

- 8 months ago

LIC, the state-owned insurance behemoth, has seen a 59 per cent rise in value of its investments in Adani group companies in 2023-24 fiscal year after the conglomerate made a smart recovery since being hammered by a damning short seller report.

Economic Times

Mahindra Lifespace among top 5 smallcap stocks MFs sold in March

- 8 months ago

After Sebi's warning against froth building in small and midcaps, and fund houses' efforts to curb inflows, smallcap counters witnessed heavy outflows in March. Here are 5 smallcaps that saw the most outflows in the last month:

Economic Times

Corrections are opportunities for long term investors: 5 midcaps with right mix and upside potential of up to 46%

- 8 months ago

For the next couple of weeks, what will dominate the narrative on the street would be the action and expectation from the US Fed and Iran’s attack on Israel and whether it escalates further or not. At a time when events where no one has any control are hitting the street, two things are most important, first, don't react in panic. Now panic is not only about selling because the news is negative, but also about buying just because stock prices have fallen from its recent high. It is time to remember that there is not even a single year in the last 25 years, when there has not been an issue which made it appear that the world is going to crumble. But the fact is good businesses have still grown, valuations have still risen and broader markets have moved higher. So, these geopolitical tensions are part of life only if one focuses on what one is investing into and puts more checks and balances so that one is able to bring in the element of margins of safety.

Economic Times

Iran-Israel war: Will Nifty bulls get trapped in cross-firing and how it may impact investors?

- 8 months ago

One of the biggest impacts of the tensions in the Middle East could be on crude oil prices. Last week, oil prices neared a six-month high on concern that Iran, the third-largest OPEC producer, might retaliate for a suspected Israeli warplane attack on Iran's embassy in Damascus. After the fears came true on the weekend, analysts feared that crude oil prices, which had settled near the $90 a barrel mark on Friday, could cross the $100 level in the next few days.

Economic Times

Technical Breakout Stocks: How to trade Quess Corp, KEI Industries and Tata Power on Monday

- 8 months ago

KEI Industries is in a strong uptrend on both a positional and intraday basis. In the short term, the upside resistance levels are at 4,087 and 4,187, and on the downside, support levels are placed below 3,830 and 3,710.

Economic Times

Value triumphs momentum in FY24 from the quant lens

- 8 months ago

A refreshing observation was the comeback made by the Value factor in FY24. In recent years, particularly since Covid, Momentum has consistently led market returns, while Value struggled to catch up. Finally, FY24 marked the year when the tables turned, and Value outperformed Momentum

Economic Times

Market valuation of 7 most valued firms climb Rs 59,404 cr; Bharti Airtel, ICICI Bank lead gainers

- 8 months ago

The combined market valuation of seven of the ten most valued firms climbed Rs 59,404.85 crore in a holiday-shortened last week, with Bharti Airtel and ICICI Bank emerging as the biggest gainers. Stock markets were closed on Thursday on account of Eid-Ul-Fitr.

Economic Times

FPIs infuse over Rs 13,300 crore in equities in April so far amidst bullish economic outlook

- 8 months ago

Foreign investors have infused over Rs 13,300 crore in Indian equities in the first two weeks of the month owing to a resilient domestic economy with promising growth prospects.

Economic Times

Israel-Iran conflict, Q4 earnings among 11 factors that will steer D-Street this week

- 8 months ago

The upcoming week promises to show top action with the Iran-Israel conflict taking center stage along with the earnings season which kicked off with the announcement of earnings by TCS. Oil prices, China GDP data, US retail sales figures, and movements in US bond yields and the dollar index will be important macroeconomic events that may influence market sentiments

Economic Times

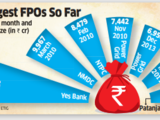

As Vi Speak: Telco to ring in biggest FPO of Rs18,000 crore

- 8 months ago

Issue priced at Rs10-11 a share; at higher end, FPO is at 26% discount to preferential issue.

Economic Times

Emerging-market bulls tout Modi premium as election nears

- 8 months ago

Investors remain bullish on India's stock market performance under Prime Minister Narendra Modi's govt, anticipating stability, growth, and continued attractiveness to global funds. Modi's focus on manufacturing, infrastructure, and addressing electorate concerns are key expectations.

Economic Times

Emerging-market bulls tout Modi Premium as election nears

- 8 months ago

Investors remain bullish on India's stock market performance under Prime Minister Narendra Modi's govt, anticipating stability, growth, and continued attractiveness to global funds. Modi's focus on manufacturing, infrastructure, and addressing electorate concerns are key expectations.

Economic Times

Dalal Street Week Ahead: Market momentum likely to fade, time to protect profits

- 8 months ago

The markets may see a soft start to the week on Monday. The levels of 22650 and 22775 are likely to act as potential resistance points. The supports come in at 22400 and22280 levels.

Economic Times

ET Markets Decoder: The journey of Sensex from 1K to 75,000

- 8 months ago

From its first 1000 points to its 75000-mark milestone - The journey of Sensex is truly remarkable. In today's episode of ET Markets Decoder, we take a look at the benchmark's flight to mount 75K. Watch!

Economic Times

FPIs net buyers of Indian equities at Rs 13,347 crore in April so far

- 8 months ago

According to the chief investment strategist of Geojit Financial Services, Friday sell-off by FPIs was to the tune of Rs 8,027 crore on fears of changes in the India-Mauritius tax treaty. This move will weigh on FPI inflows in the near term, till clarity emerges on the details of the new treaty.

Economic Times

Which are the priciest & cheapest stocks in 'Magnificent Seven' group? Take a look

- 8 months ago

Meta's record-breaking, Al-fuelled rally has added $1 trillion in market value since its darkest days of 2022, and yet by some perspectives, it's still trading at a discount. Its shares traded 24 times estimated earnings this week, roughly in line with their 10-year average and just below the 25 times of the Nasdaq 100.

Economic Times

Global volatility, domestic solutions: 6 largecap stocks from different sectors with upside potential up to 47%

- 8 months ago

There are two things which have rattled the global markets. First is the confusion on how to interpret the statement/ data/minutes of the meeting of the US Fed. There is no clarity after the recent inflation number on how things will pan out. Second which has come after some gap is the geopolitical tensions, the development of possible war between Iran and Israel. This means disruption in trade as it is in an area which is logistically important and second, it will have an impact on crude oil prices, which means that inflation in the US may become more sticky. So, this time the probability of geopolitical tensions leading to higher disruption for the global economy and hence for the equity market is high. The next logical question is how to deal with it. The answer lies in history, whether it is geopolitical tension or interest rate cycle getting unexpected disruptions, they keep happening. What one has to focus on is stock selection and owning good business and volatility whether global or domestic is taken care of.

Economic Times

Making a comeback after 3 decades? 4 stocks of sector-specific term lending institutions with focus on power & railways

- 8 months ago

Term lending institutions as a sector or as a set of companies is not something which many on the street would know or remember because this word was used a couple of decades back when ICICI, IDBI were not banks. They were term lending institutions who used to give loans to companies for specific projects for a specific period of time, which used to be normally longer term as compared to banks. That model failed for multiple reasons that is why the word “ term lending institution” became a bad word or one can say went into oblivion. The one company which did not change itself for multiple reasons is IFCI and we all know what happened to it. But if one looks at some of the companies, their essential model is to provide capital for the long term. The only difference is that they are catering to specific sectors, the whole chain of companies in that sector. So they can be called “ sector specific term lending institutions” and yes they are once again back on the street because there is a world of difference in today and what things were 10 years back.

Economic Times

ITC, TCS among top largecap additions by mutual funds in March

- 8 months ago

Among the funds shopping for ITC were ICICI Prudential MF which topped the charts with a share purchase worth Rs 4,892 crore. As for TCS, SBI MF's prominent addition in March was this IT stock where the latter bought shares worth Rs 2,205 crore

Economic Times

Making a comeback after 3 decades? 4 stocks of sector-specific term lending institutions with focus sectors like power & railways

- 8 months ago

Term lending institutions as a sector or as a set of companies is not something which many on the street would know or remember because this word was used a couple of decades back when ICICI, IDBI were not banks. They were term lending institutions who used to give loans to companies for specific projects for a specific period of time, which used to be normally longer term as compared to banks. That model failed for multiple reasons that is why the word “ term lending institution” became a bad word or one can say went into oblivion. The one company which did not change itself for multiple reasons is IFCI and we all know what happened to it. But if one looks at some of the companies, their essential model is to provide capital for the long term. The only difference is that they are catering to specific sectors, the whole chain of companies in that sector. So they can be called “ sector specific term lending institutions” and yes they are once again back on the street because there is a world of difference in today and what things were 10 years back.

Economic Times

Mukul Agrawal adds 2 smallcap multibaggers in March, trims stake in 3 and likely exits 2 stocks

- 8 months ago

The ace investor bought 1.80% stake in Dredging Corporation of India while shopping for 5.53% in Oriental Rail Infrastructure in the January-March quarter. Both stocks have delivered multibagger returns of 154% and 555%, respectively, in the last 12 months.

Economic Times

Jeremy Grantham’s 10 tips to achieve investment success

- 8 months ago

Famed value investor Jeremy Grantham says the best returns on investments do not come from taking the biggest risks but from buying the cheapest assets.He says the lesser an investor pays for a stream of earnings, the higher will be the chances of his return over time.

Economic Times

10 investment mistakes to avoid & make your portfolio ‘dent-proof’

- 8 months ago

“One should have liquidity when it comes to their portfolio for rainy days. Keep 6 months' worth of expenses parked in a separate basket of liquid funds,” says Chirag Muni.

Economic Times

Why is Bitcoin halving 2024 different from previous ones? What investors must Know

- 8 months ago

As investors navigate the intricacies of the 2024 Bitcoin halving and its implications, vigilance and adaptability will be key. By staying informed and attuned to the unfolding narrative surrounding the halving event, investors can position themselves to capitalise on emerging opportunities and navigate potential challenges.

Economic Times

8-step process to build scientific hypothesis of successful trading

- 8 months ago

A scientist and a trader are both alike. They form their hypothesis, test them, and check the results. If the result matches the hypothesis, then they conclude. That’s how you make sense out of the randomness in nature and markets. Until you have a hypothesis that can be tested and proven whether it is working in markets, you will be a gambler.

Economic Times

Block deals worth over Rs 10,851 crore this week. Tata Technologies, Adani Ports among stocks with major action

- 8 months ago

The leader in the midcap segment was Gland Pharma with deal size standing at Rs 1,559 crore followed by Tata Technologies (Rs 400 crore), Fortis Healthcare (Rs 185 crore) and IDFC First Bank (Rs 177 crore).

Economic Times

Bajaj Finance, Bharti Hexacom among 7 stocks on which brokerages initiated coverage

- 8 months ago

Several brokerages, both global and domestic, have initiated coverage on a variety of stocks, expressing bullish sentiments towards companies such as Bajaj Finance, IDFC First Bank, Bharti Airtel, and Bharti Hexacom, projecting potential upsides of up to 40%. Here's a list of 7 stocks for which brokerages have initiated coverage:

Economic Times

In a steep fall from 400, only 25 smallcaps offer double-digit weekly returns

- 8 months ago

About 22 stocks, including HMA Agro Industries, Mangalam Cement, HEG, Hindustan Copper, Motilal Oswal, Hariom Pipe have offered returns between 10-20% during the week.

Economic Times

Risk-addicted Wall Street funds are shaken as bad news piles up

- 8 months ago

Jerome Powell navigates monetary pivot amidst inflation decline. Geopolitical tensions challenge high stock, credit exposures. Israel-Iran strife impacts S&P 500. Goldman, Barclays revise rate-cut bets. Risk allocation analyzed. Northwestern Mutual adjusts stock exposure.

Economic Times

Global markets mixed after Wall St rebound led by Big Tech

- 8 months ago

Oil prices were higher. The future for the S&P 500 slipped 0.1% while that for Dow Jones Industrial Average edged 0.1% higher.

Economic Times